The Next Big Crypto Narrative

A Search For The Supernatural

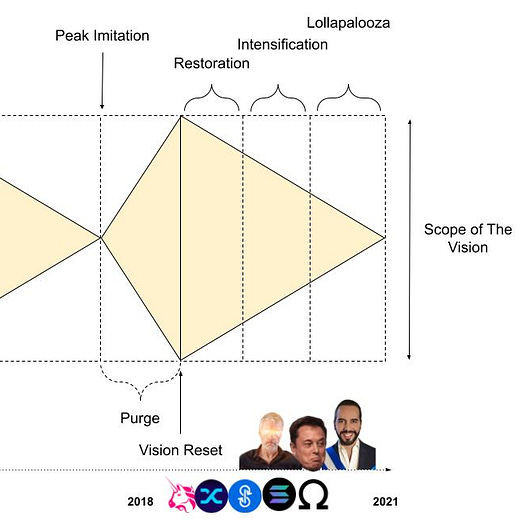

As we are making ourselves comfortable in the bear market I’m noticing people are already looking to skip ahead to the next stage as soon as possible. Careful, as history shows, the bear always has a specific way of playing out.

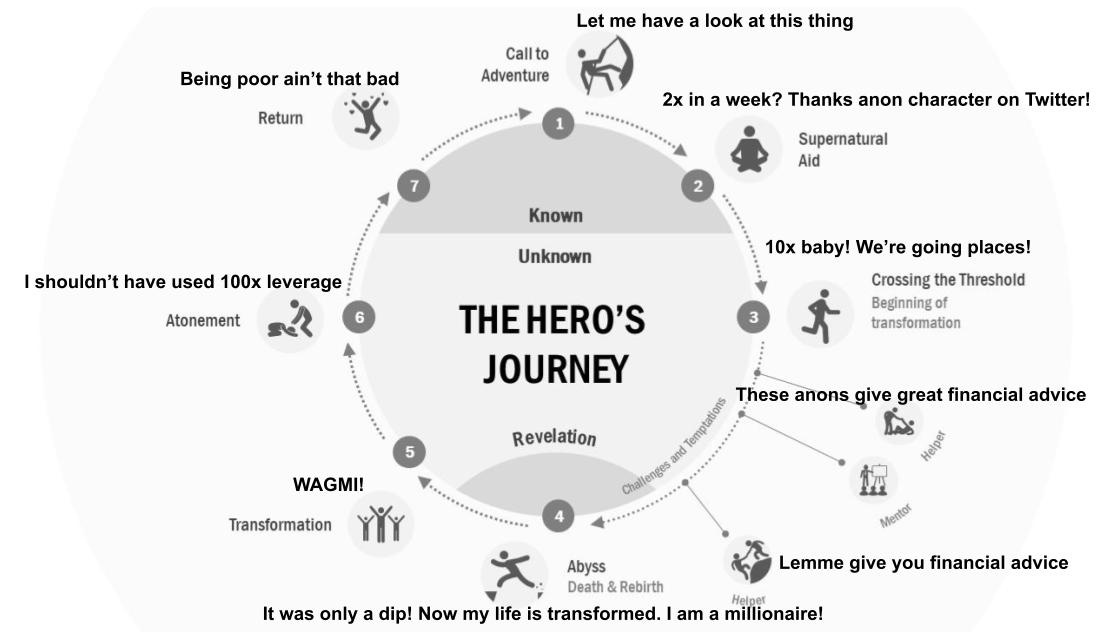

Your personal journey through the crypto cycle is not far from the archetype of The Hero’s Journey. Getting from the point of “return” to a new “call to adventure” takes a while. It’s best to avoid the inkling and sit patiently for a while.

Some are always ready for the next adventure, hailing every possible narrative as a supernatural aid. But supernatural aids do not come that often. Today we are living in the real world (of growing interest rates, inflation, and economic war) - here it feels like the supernatural never comes.

Before we can ask for the supernatural to occur, it will come to feel like we have lived at the bottom forever. The word “bottom” drops from our vocabulary because the world becomes flat and every 5% up or down will feel like an event.

On this journey to the next bull market we will meet fake prophets, some of them even talking about these weird things called “fundamentals”, which they have shunned all the way through The Great Bull.

It is ironic that we laugh at fundamentals when times are good but beg for the market to recognize them when times are bad. There is one I’ve heard of recently. It was given the name of “ETH Merge”.

Although fundamentally a significant event, those who hope for fast salvation will be bitterly disappointed. This is not how things usually work. It will take time for such an important event to be widely recognized by the market.

The greatest disappointment comes when those who affirmatively called the bottom might rediscover new lows. This is when most lose all hope. Fear turns into disappointment which then turns into lethargy. Things get boring and it will feel like we’re going nowhere.

But while most lose interest, unbeknownst to them, there are people who work on tools that later, through the magic touch of liquidity, turn into supernatural aid. To not blunt our senses in the upcoming dull period ahead (after a healthy dose of volatility), let’s explore the potential narratives that could once be revealed as our supernatural aid.

*Knock-knock.* - “Who’s there?” - “It’s Macro”

For crypto as a risk-on asset class, the true supernatural aid is the FED printing machine. But that goes for almost every asset class. If the builders sat on their hands for the next year or two - the new hype would not be that glorious. The new shiny thing narrative matters and is an essential part of the industry’s vision reset.

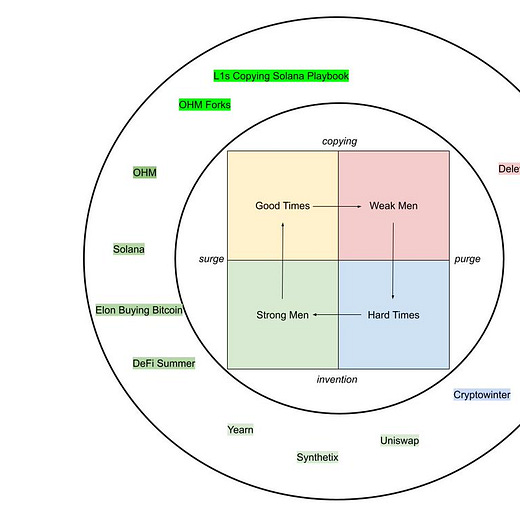

Until we get to the new shiny thing crypto narratives turn macro-reactionary. So when there is a lack of innovation because everyone is busy getting sober and the technology does not change - we look outward to the world to change its stance towards this new asset class.

This has been repeated over and over with bitcoin which reliably changes its narratives every now and then. Crypto had cried in unison that “the institutions are coming” since the market crashed in 2018. Institutions came but not when everyone was crying for help. They came when everyone was busy watching their bags pump.

Bitcoin as a technology does not change. Bitcoiners are missionaries, skillfully maneuvering around global macroeconomic events to pitch the dogma about the one true coin, window-dressing it in the process. From the payment system, through digital gold and inflation hedge all the way to Swiss bank accounts in the cloud/credibly neutral bonds.

The other credibly neutral asset to pitch is Ethereum which is getting its new upgrade. ETH has matured enough to be in the position of its narrative becoming macro-reactionary too. ETH is now robust enough to compete with bitcoin on the macro narrative scale. Plus it offers a yield.

In terms of current macro events, there is a line of thought that suggests we’re experiencing a grand macroeconomic transition caused by geopolitical events. It is a new rendition of the clash of civilizations: East vs West.

Apparently, the bottom-up micro understanding of central bank machinations is useless in times when geopolitical realignments are happening. This is not a peacetime economy but a war economy, meaning that liquidity is being pumped into building the real stuff and fewer online casinos (not good for crypto).

This line of thought is based on the premise that inflation is not demand-driven but structural (supply-driven) and will not be alleviated any time soon because there’s a hot war in cold places (economy, cyberspace, etc.). Globalization has ended and global trade will get fragmented.

We’re hearing about countries considering diversifying from the USD to settle international trade due to the freezing of Russian central bank foreign currency assets. USD is not credibly neutral which in war times could be an issue for those non-compliant with those running USD masternode.

I expect that crypto will try to spin out a couple of narratives around these geopolitical events. Some may even become true in time as the credibly neutral money is fundamentally a strong proposition. Can the cloud kingdoms of ETH and BTC defend its sovereignty and profit from the war just like Switzerland during World War II?

New Shiny Things

In the past, macro narratives have usually accumulated power over time and accelerated only once they had been commingled with the technology trigger of the new shiny thing. We should not be relying on macro narratives but rather explore the potential micro-narratives of the future.

The Great Bull of 2021 started with the DeFi summer of 2020. The speculative self-referential feedback loops of lending aka farming were the catalyst. After that we got NFTs and GameFi within the same cycle. But what promising technological triggers lay ahead?

Actual DeFi 2.0

Although we’ve heard of DeFi 2.0 I don’t believe we actually got there. If there is DeFi 2.0 it’ll be revealed no sooner than in a year or two. I’m including some ideas of what could DeFi 2.0 be like:

More sustainable yields

More sophisticated on-chain tools including an ability to building sophisticated structured products

More KYC (sounds terrible, but it would be nice to employ some ZK magic to maintain privacy)

Products connected to the real economy (means not memes of production)

New stablecoin experiments (probably not algorithmic this time)

I’m still carefully watching OlympusDAO as I believe in the mission of building a the fiat-independent crypto reserve currency

At the beginning of Covid crisis in March 2020 I was searching for real world applications of DeFi because I thought the world would head towards a localist mode with global travel and trade crumbling, imagining local lending dapps as a crypto extension of the real economy. Maybe this time someone will come up with a WIR franc crypto model.

Today I am curious about how we bridge DeFi to actual commerce. Bridging this gap would allow DeFi to grow into more sustainable products and Web3 native solutions that are not purely based on speculation.

Web3 Commerce

The answer here seems to be GameFi . With a massive early success, dapps like StepN are in a position where they actually captured users but now have the challenge of translating tokenomic ponzis into sustainable commercial relationship with its users.

In-game purchases, referral fees, utility NFTs and other items, could actually turn our heads towards decentralized commerce. I have not seen any successful prototypes but getting people to spend money on blockchain on other things than gas fees or speculation is something we need.

Another rendition of decentralized commerce could be related to content production and monetization. I can imagine DAOs owning IP rights to Tolkien, Harry Potter, Star Wars and other franchises. Community owned and operated media companies are an interesting proposition given crypto’s natural tendency to power capital formation.

Although people are getting skeptical about DAOs, it’s important to accept that their failure rate will be no different to startups or companies in general. They could still be an efficient governing body for content production and monetization. Getting to that stage requires a Discord meets Kickstarter type of app as we need a slick UX.

The lowest hanging fruit of Web3 commerce is gaming on blockchain where in-game items are truly owned by people and perhaps they become more important than the games. This lends itself to pivot in which the games are built around the items that become portable across different games.

Web3 Social

This is already a hot topic and we have provided a lengthy thought piece on the matter. Most critics would argue that doing “social on blockchain” is redundant. Web3 social will try to separate the social graph and the platform, making users sovereign in the digital domain and their connections portable across various social venues.

If Web3 social is for the crypto community only - it will likely fail. It’s not enough to provide ideological motives. The key here is to introduce new forms of monetization which overlaps with the aforementioned “Web3 commerce” narrative. These new tools must be intuitive and easy to use.

Going back to crypto’s main advantage of frictionless capital formation, the next era of socials could emerge around crowdfunding and community governance. Social media is already a big platform for content monetization. Web3 solutions could broaden possibilities for creators and their audiences.

That is why if NFTs are intrinsically linked to the future of social media, the next major social application will be crypto-powered. The question remains: is the future of social media truly intrinsically linked to NFTs or is it a red herring?

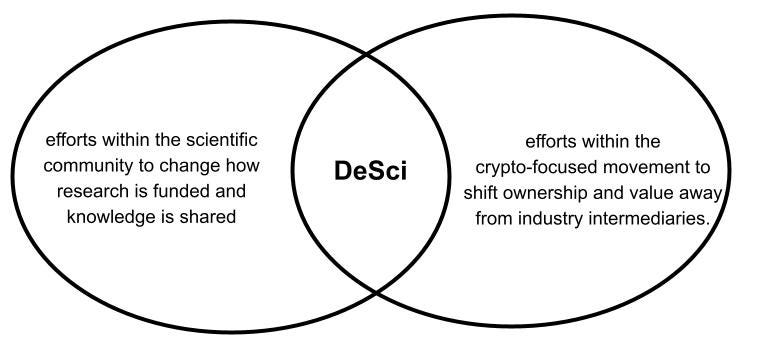

Decentralized Science (DeSci)

As per future.com, this trend lies at the intersection of two broader trends:

In short, in addition to the systemic failure described in the introduction, the problems with the scientific community or academia could be described as:

Institutionalized academia produces career bureaucrats that optimize for internal reputation (journal publications) rather than risk-taking, which has historically led to innovation

Funding of innovation within the scientific community is centralized, corrupted, unproductive, and does not resemble the original tinkering/entrepreneurial nature of scientific discoveries

Knowledge is closed-source and locked behind paywalls. This way data (& power) are concentrated in the hands of a few major publishers.

With online communities funding research that helps alleviate their specific problems is an interesting prospect. Necessity is the mother of invention. I’ve seen many people sharing tips regarding health issues online, especially in cases in which modern medicine has no real answers.

Giving them the ability to fund research and potentially develop a cure for their ailments is an exciting prospect. But turning Reddit into a crowdfunding platform that powers scientific discourse, research, and development, seems outrageous (maybe that’s why it’s so cool).

World of Atoms

This is indeed a wild proposition for most mum’s-basement-dwellers. I hold hope for this becoming a narrative spanning across all of the above. What I mean by “World of Atoms” is a connection between crypto and the production economy. Real stuff.

Looking back at 2018 we realized that strawberries on the blockchain are not really that revolutionary but maybe it is time to revisit some of the ideas we had back then when the technology at our disposal was less mature.

Things like Energy Web are still out there and even though I think it’s a long shot, it’s an effort that tries to achieve something that even ordinary people could benefit from. Optimizing the grid and decentralizing energy marketplace is an interesting idea in times when we talk about the energy crisis (still we probably need more cheap energy first, especially in the EU).

There are potential synergies that could focus on crypto lending to local businesses, maybe DAOs forming to build physical stuff or produce goods (Nuclear Fusion DAO). All of these are angles that are rather unexplored as it was easier to fork OHM and dump on retail.

In the bear market, there are no real low-hanging fruits, meme coins rarely pump and builders have to dig deeper for inspiration. On the brighter side; necessity is a mother of invention and maybe it’s time that crypto looks outward and tries to solve real problems of regular consumers and producers.

Beyond Max Pain

There may be other narratives that will carry us into the future as many founders are working on things like decentralized compute (yes, again) and other niche solutions that I can’t think of. It does not mean that if things failed in the past they can’t work in the future.

Anyways, it’s best when we actually get surprised by the imagination of builders. We will be on the lookout for new ideas and new narratives that will enable us to reimagine the future.

In the meantime let’s not get overly pessimistic.

so there's an interesting solution to some of the DAO fundamental problems brewing over in Dotsama by a project called Invarch. This is some big brain stuff but it's just easier to read the OG twitter thread and start digging in from there as that is just the initial alpha drop but it's continuing. Now the thread is specific to the first instance of the tools, but any DAO can incorporate this DAOist SDK. https://twitter.com/YoudleDAO/status/1569125408427089922?s=20&t=SFQmH1bSn3FhjacGPCvCkQ

This is basically how I have felt since I started feeling like a downturn was coming around January. Also, I appreciate the fact that you date the recent bull market to DeFi Sumer. Normies and my fellow journalists tend to date it to the 2021 NFT boom but I think that foundation was laid in DeFi Summer.

My take on what's next is I guess sort of reflected in your very, very last little bit but I guess I will say it stronger.

People are working on a lot of things right now and some of those things will probably matter long term, but we won't see the new shiny thing coming till it's here and most of us will say the shiny new thing is bullshit when it first shows up, just as so many folks did about NFTs for about 3 years there.