Indeed, history is nothing more than a tableau of crimes and misfortunes. - Voltaire

I have written the first part of what is now a trilogy in the fall of 2020 and then followed up in early 2021 with the second part. Two years later I am publishing a third and final installment of the series.

The previous two parts talked about how reflexivity becomes a subject to mimetic desire and how unlimited money (framed as unlimited optionality) makes the world seem much more malleable. At the peak of the bull market, it was so easy to form an investment thesis based on memes of production.

The world today seems different. In 2022 the macro FUD reached new heights. The self-fulfilling nature of pessimism has kickstarted a flywheel down.

In crypto, the pessimism was very palpable. Cryptoheads, being naturally skeptical of the existing economic order, realized that its fate seems to be intrinsically linked to liquidity provided by the boomer overlords. The future of France experienced a sobering moment after a frenzy.

The unwinding of the LUNA crash is taking its time while wreaking havoc on our little industry. We learned that leverage is a helluva drug. It is also a thin barrier separating a king from a thief and a hero from a villain. We came to a realization that our industry is not that different from the one it’s trying to replace and backroom deals are a big part of it.

Questions I pose today are: Is there a path forward for crypto in the environment of evaporating liquidity? How could crypto become the promised land if it is a slave of the old world’s monetary regime?

To find the answers I will revisit the past and think about the future through a Girardian lens and explain how the degen culture led to our downfall and how we’re now expelling it from the crypto community. Fyi: I’m checking out moral judgments at the beginning of this essay.

Degen Kings

The old Girardian story goes as follows: imitation leads to competition, which leads to a war of all against all where, to prevent destructive violence, the community unites in a ritual of scapegoating. People find someone to blame for all the mess, washing the sins of the community so that the rest can carry on.

“In ancient religions, this violence is collectively released through the sacrificial scapegoating of a victim, who is expelled by the community. After the sacrificial event, the sacred victim—which later, often, gets persevered in myth—eases the mimetic tensions and reconciles the threat of eternal violence.” (from Manias and Mimesis)

It is difficult to call Do Kwon, Three Arrows Capital, and SBF the triumvirate of scapegoats as a Giradian scapegoat should have been innocent at its core. Let me propose a context in which the three villains are innocent, or at least no more guilty than the rest of the degen population.

The three above represent the Degen Kings who have allegedly taken their degenism to potentially criminal behavior. Based on the information we have been provided we’re assuming that at some instances potential criminal activities took place.

The inconvenient truth is that these max-degen scapegoats (allegedly also a guy named Barry) were the accidental masterminds of our last bull market that many of the regular degens and non-degens benefited from. The secret ingredient was leverage. Fraud could also become a form of leverage.

There are many regular degens using leverage in a destructive way, however; their options are limited. The stories about husbands sinking their and their spouses' savings into crypto without the knowledge of the spouse are not that dissimilar in nature from defrauding business partners and customers (just with more severe legal consequences).

Would the majority of these degens do the same if they had an opportunity? Is it the virtuous high moral ground that stops them from using it or is it the skill, the access, and overall circumstance?

We do not know the answer but I would propose that these things work in fractals. Majority of the degens using maximum leverage are inherently the same, some just have access to ways normie degens don’t.

In that sense, the triumvirate of Degen Kings is the Girardian scapegoat of this cycle because they are just a higher-order fractal of the degen population that cheered them on when things were going great.

Being a degen was something cryptotwitter aspired to with a great passion back in 2020 and 2021. Today we know we were wrong in embracing the degen cult because it (allegedly) escalated into stealing customers’ funds which in a sense constitutes criminal leverage.

Opportunity makes a thief. Things spiral out of control just like in Zimbardo’s prison experiment [1] because leverage, just like power, is a helluva drug.

Today many publicly lynch them with passion, thereby expelling the max leverage demon archetype from the community. People rarely see their own greed but are quick to recognize it in others. The shadow of self remains hidden, thus persists in the community's subconsciousness and will likely emerge again when the conditions are right.

We Were Wrong

As degen kings were being expelled and we were trying to wash away the sins of the community we destroyed our hopes and dreams in the process. The repenting on cryptotwitter became more tangible throughout the year and at the end, it erupted into nihilistic exclamations.

With the demise of SBF, there became a vacuum of an ideal to which the industry could hold onto. Ironically, the cryptotwitter shouted “no more hero worship” but in the foreseeable future, they will (need to) find a new false idol. Deification (and scapegoating) is one of the main reasons for the existence of cryptotwitter.

The chaotic war of all against all has conveniently reformed into a united cry for blood embodied in Gabriel Heines’s parody hunt for SBF. It cannot be us who were all wrong, it was these bad actors deceiving us and we blindly followed. Shame on us and death to them.

Disillusionment is a difficult period because there is hardly anything to which we can aspire. We cannot go back to our old non-crypto ways but we cannot go forwards with new ideas because we just killed the who-we-thought are leaders of the revolution. The mid-IQ macro analysis is what dictates narratives.

The mid-IQ is a reference to the tragedy of the mid-wits. In the mid-wit world, everything is predictable. Crypto has no future in the world of mid-IQ because its run was pure speculation fueled by low-interest rates. Everything is going back to the old normal, “real interest rate virgins” returning to cubicles en masse to learn value investing.

Fear turning into outrage. Outrage turning into lethargy. Lethargy turns into melancholy. Melancholy turns into hopelessness. The radical, now dangerous, ideas are being repressed under a united cry of “how could we be so foolish?”.

Amidst this outrage, people are oblivious to the fact that they’re throwing out a baby with the bathwater. Fundamentally the failures of this cycle have nothing to do with crypto, be it the technology or the ideology.

It takes a while to tame passions and restore order. Then comes a new spring of ideas that will fuel the new wave of the revolution. Or perhaps it could actually be the reformation that will help kickstart the flywheel up.

Through The Pass Of The Dead

In the past I have discussed the Boomer order; the (mostly but not exclusively) gerontocratic ruling elite that tries to conserve the changing world, not unlike the monarchy at the brink of the 20th century. In a sense, the source of Boomer legitimacy is the access to infinite money printing, preserving the bureaucratic class of academics and politicians.

To reframe this; their main source of legitimacy is not making peasants (us) too poor. Rather sooner than later, they will come to use the ring of power - liquidity. But perhaps crypto does not even need to wait for that moment.

Maybe, just maybe, legitimizing crypto will be enough to kickstart the flywheel up once again. We asked for revolution. We get a reformation. The TradFi, just like DeFi, is addicted to liquidity, and the survival of its order is intrinsically linked to the power of the ring.

I believe that the “crypto regulation” presents an opportunity for a seeming transition of power without revolution. TradFi turns into DeFi and we will pretend we have just discovered new things whereas in reality, it’s mostly old things with new names. A smooth transition requires the old guard to safely transfer riches into the new world.

To give an example, the most influential and richest people in the Eastern bloc post-socialist transition were people with affiliations to the former single party who understood the new game that is being played. What looked like a revolution was a regime transition with many of the old elites benefiting.

An attempt at a peaceful transition is what we’ll see unfolding in the near future. In the West, the banks could embrace crypto on their own terms (perhaps to fend off central banks’ potential attempt to become direct-to-consumer). People will start to get rich again but in an order, it usually happens - institutions first, people second. In such circumstances, tamed crypto becomes a convenient tool for the boomer order.

The reason why crypto has been in conflict with traditional finance is that they are too much alike “as only similars can be profitably contrasted, so only similar people quarrel and the bitterest wars are over the slightest variations of purpose or belief” [2] . Both want to control the same thing.

Over time it is customary that when the two foes fight for a long time they become more and more alike. Eventually, the elites of the old and new will intermingle, and those who will resist will be sidelined as anarchy is rarely profitable.

Girard teaches us that it’s dangerous when people want the same thing rather than the opposite. This is how a subtle imitation turns into a mimetic desire. I’ve come to believe that the biggest bull market in crypto is the one in which crypto becomes a legitimate tool, allowing it to spiral out of control.

Only then, the real disillusionment sets in, and the slope of enlightenment will be produced. Crypto did not (yet) experience the “Lehman'' moment because the crash of 2022 did not end with a bailout but a bail-in. I posit that crypto’s Dotcom meltdown and its true Lehman-like moment is yet to come and is linked to the actual legitimization of crypto.

Perhaps this crypto quest once began with Satoshi as Frodo, trying to destroy the ring of power in the depths of Mount Doom. But similarly to Frodo, we as a community became unable to complete the task as we have gotten consumed by the power of the ring.

The startupization of crypto means people no longer care about the actual revolution but rather wish for a profitable regime transition. Crypto enslaves just like the money printer because it is its extended arm. The desire to see the number go up is too strong.

The Return of The Memes

I would not like to detract from the actual usefulness of the technology as crypto has a lot to offer. There are new things being built and every crypto cycle requires a technological novelty narrative to get it going. Believe it or not, there are people that are “in it for the tech”. The markets will make good use of them.

The malleability of the world stemming from easy money is still here. The kinetic energy of QE has turned into potential energy. For crypto, the temporary halt on liquidity is more imaginary than real. We’re making mid-IQuers great again by virtue of a negative self-fulfilling prophecy rather than by the gravity of fundamentals. Mind you, pessimism is almost always self-fulfilling.

Indeed there have been margin calls and there is a real problem stemming from the max leverage degen unwinding. But I do not think one should expect the FED or Twitter to broadcast the next crypto bull run. The memes will rule the world once more but perhaps next time “stonks” will not be distracting the retail audience.

Liquidity or not, we await the decoupling for which regulation could become a catalyst. The Dotcom bubble happened when interest rates were roughly at 5%, with real yields in positive territory - conditions unseen by the degens of the 2020-2021 crypto cycle. How much liquidity do we really need?

In the past, I wrote about Thiel’s advice to “find a way between the Scylla of outdated wisdom and the Charybdis of nihilistic cleverness”. This is still valid today. If you become immune to outrage you might see that the era of bubbles has not ended.

To liberally quote Archie from Rocknrolla: “There is no spring without a winter. No life without death. And the demise of degen kings has blown a new season into the lungs of the young crypto community.”

Until the next time Mr. Max-Degen.

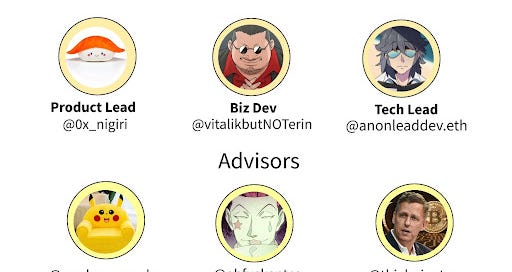

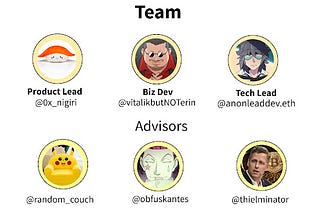

Thanks to longsolitude, fiskantes, Brady, and Matt, for their useful comments.

Footnotes

[1] “Zimbardo concluded that people quickly conform to social roles, even when the role goes against their moral principles. Furthermore, he concluded that situational factors were largely responsible for the behaviour found, as none of the participants had ever demonstrated these behaviours previously.” (Source)

[2] Will Durant, The Story Of Philosophy

JFC this is an amazing read.

I've read thousands of articles about Crypto, but none capture its its essence in relation to society, popular culture & memes - its soul - like this one.

Congrats on a master piece!

Fantastic as always