When my tweet on crypto readings for newcomers went “viral” I learned that this type of thing is valuable to my audience. That is why I have decided to write this simple guide for people who are relatively new to this space.

I understand how difficult it can be to navigate the dynamic and chaotic crypto space. The goal of this post is to help relative newcomers make sense of the information overload so that you can build a foundation that helps you to last in the space longer than just one bull market cycle.

I’m generally skeptical of advice and that’s probably a lesson #1 in crypto: Be skeptical of any advice. At the end of this guide you should be asking “Is this just a psyops?”. If you are not asking it, this guide has failed you.

The Basics

The first rule is to survive. Don’t go broke, meaning do not go all in and do not be liquidated. Sell only on your own terms. Don’t chase astronomical gains as you’ll force yourself to believe in things that you do not believe in. Wishful thinking does not help you survive.

Make sure you read Fred Ehrsam’s post on how to survive the crypto cycle.

Curiosity is the best predictor of longevity in this space. If you’re curious - you’re likely on a path to transform the speculator in you into a builder or a power user. But sometimes you have to follow more cues than just the price.

You would want to find your place. Think of this as a quest to find out how to become useful for other individuals even if you came here to only chase generational wealth. You don’t have to quit your boomer job to participate, just spend your weekends trying to find out how to be help likeminded people in the space.

The best thing is to surround yourself with people who can also help you. When I started in crypto I felt pretty alone. I am very lucky that over time I have managed to surround myself with people who were in a similar position. If you cannot meet people in the meatspace, Cryptotwitter (CT) is where the community hangs out. The right exposure is critical.

If you are not on CT then you’re probably missing out. Everyone’s CT is a slightly different experience as it depends on the accounts you follow and engage with. For starters you need a good group just like when you were in school. Your parents probably did not want you to hang out with the bad crowd. The same rules apply to CT.

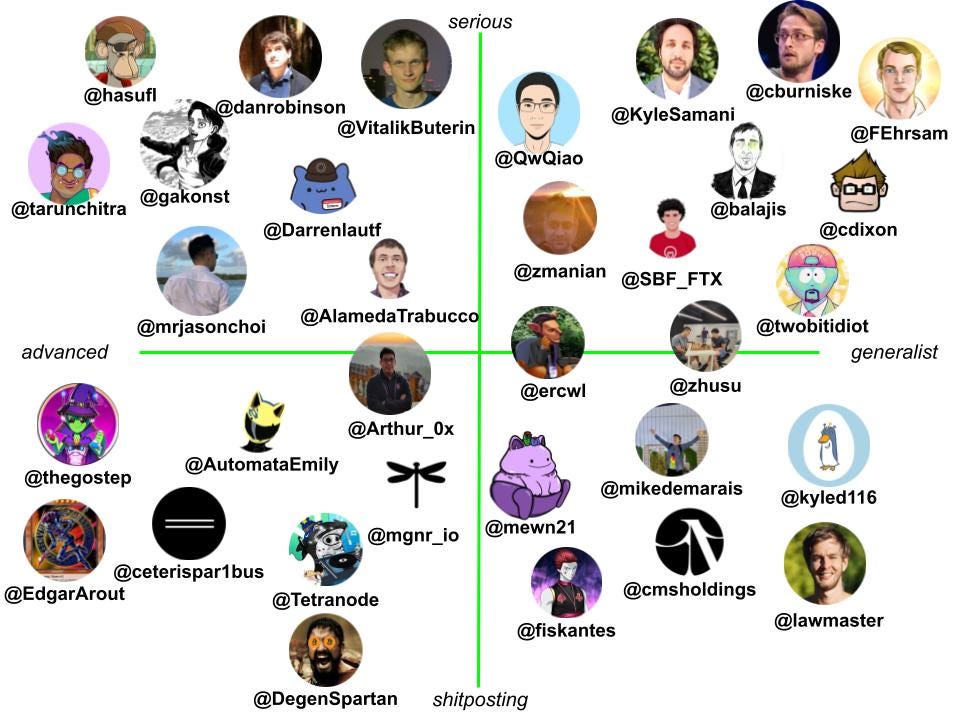

I’m providing a mix of curated accounts for you to start following and populating your social and knowledge graph. These are my picks so it’s a biased list. Only consider these “the seed accounts” for your own personal algo. Make it grow in all directions and by following your curiosity.

The x and y axis were just eyeballed to provide some context. I realize that the above accounts skew heavily into ETH. That is why I’m providing some additional accounts for the non-ETH ecosystem. See the full list here.

Additionally, if you do not like my personally curated list you can check out hive.one for a list of algorithmically curated lists of most influential accounts in the whole crypto but also individual clusters like BTC, ETH, SOL, DOT or NFTs.

Make sure you follow the crowd who expands your knowledge and opens your mind. Individuals around you can cue you into the best position for you. Following people that ask the right questions and hint at the most interesting answers will serve you best in providing an answer to your key question: How can I be useful to like-minded people in crypto?

CT Disclaimers

Although some people like to talk about leaking alpha on Twitter, most golden nuggets are merely a smart beta play. Be suspicious of anyone claiming “alpha”. The true alpha gets synthesized in your mind from bits and pieces of Twitter, governance forums and private conversations.

The chatter on CT greatly captures the current mood and is good at determining what’s going on right now but it’s less accurate in predicting where we are going. The next big thing could lay beyond CT.

Sometimes we tend to forget the value of someone who is thinking outside of the bubble and does not participate in the circle-jerk. Make sure not to overestimate it as CT is mostly where the selling takes place. But grasping CT will help you.

TGs and Discords

Once you start treating Twitter as a discovery layer, you probably want to join selected Telegram (TG) or Discord groups to do your deep dives. Usually focus on a few and try to sense the vibe of the project and inquire whether there are ways you can help a given community.

Public Telegram groups are almost always noisy places where one can hardly navigate or have a meaningful conversation. Almost all crypto projects have a Discord channel already in their infancy. This is much better for a structured research of the project and a conversation.

Examples of thriving and inclusionary Discord communities are Alchemist, OlympusDAO, KlimaDAO, Forgotten Runes and Abacus.

(Disclaimer: Zee Prime is invested)

Readings & Pods

Even though I have covered some of the foundational reading in the aforementioned Twitter thread, there are still some things, maybe more niche, that are worth it. That is why I have created a resource guide, categorizing interesting readings & podcasts in the space.

Please note that it may include ideas that are already outdated or invalidated but this does not make them less valuable.

Also, if you’re looking for a great crypto pod, it does not get better than Uncommon Core. If you want to listen to something more technical Zero Knowledge Pod is for you.

📖 GO TO THE GUIDE HERE

“But I am not a builder!”

One problem of the industry is that it mostly identifies coders as builders. That’s not entirely correct. There are so many productive endeavors in crypto that do not involve coding but are of great value to the community.

I have 2 answers for those “Oh, but I don’t know how to code”:

1. Some of the smartest people in crypto I know are not coders

2. Learn to code if you feel it could be your thing (Hayden, the founder of Uniswap learned Solidity by trying to implement Vitalik’s blog post and now he is leading one the biggest crypto project out there)

There is so much that needs to be done out there. Projects need community managers, governance organizers, project managers, product owners, marketing or sales personnel and so on. Lurking in Discord groups and being active when needed is the best way to flex your proactive beginner muscles.

Making It Through The Cycles

It all started with bitcoin and that is why understanding bitcoin, bitcoiners, the related culture and ever-changing narratives is a solid foundation. Why do bitcoiners call every token a scam? Why do bitcoiners hate ethereans? Why do ethereans hate Solana and Polkadot?

Crypto is full of conflicts. These conflicts will likely continue. Given that the semantics and epistemic are different for each cluster it is hard to agree on fundamental truths.

It is often the timing of your entry into crypto that defines your worldview or cryptoview. If you came in 2013 and made a fortune buying bitcoin your perspective will be different than when you came in 2020 and made your fortune holding SOL.

Many people get stuck once they “make it”. Hence the point that it’s enough to be right once to make generational wealth. Then you’re likely to defend your wealth and want others to help you protect it albeit this might be less profitable to them.

Here we stumble upon the problem of “being early”. Why a problem? Once a project becomes successful that success is “already priced in”. To hope for another 10x when something is 100x up already could be desperate. Manage your expectations.

Everyone has their sight set at 100x or 1000x. To find these returns is rare and to do this without getting lucky requires some knowledge of the space. It’s not a great idea to chase astronomical returns when you just got here.

If you’re not early to big things you’re driven to things in which you’re early but oftentimes it could be a lower-quality project as seen with countless OHM forks this cycle. Beware of copycats. It rarely is a copy of something that creates sustainable wealth. There is a thin line between being open-minded and being naive.

With time you will learn to master balancing between closed-mindedness and too much open-mindedness, between the “my coin is the only coin” and “hey, this fifth copycat of X sure will pump”. But there is no prescription on how to define the middle ground.

The most successful people are moving through the cycles and narratives and don't get stuck. The truth is that every cycle teaches us something. And the winners are usually those who are flexible and always discount the present and focus on the future.

Getting married to ideas is suboptimal. It is good to get rid of some path-dependence and separate your past from your future. Crypto changes rapidly, be able to change with it but do not forget the lessons of history.

Bitcoin made us think about trustless systems. ICOs taught us about novel ways of capital formation and futility tokens. DeFi summer made us rethink tokens and their distribution. There are countless lessons that have been learned before you came here. Try to get familiar with them to not repeat the same mistakes.

Conclusion

Your success in crypto probably depends on your ability to “to follow your curiosity”. There are different ways you can follow it. You try to learn how to build your own MEV bot or you can spend days reading up and contextualizing the market.

Curiosity and drive are the best predictor for success in this space. Build a foundation through already established communities and then venture into the unknown. Formulate theses and then be able to update them.

But process is less important than substance. Find your own way. Ask better questions and talk to smarter people. Joining a crypto tribe can make you feel like you’re taking part in history. And likely you are.

Subscribe to Wrong A Lot

Musings of the optimist