Recently we had a call with a founder that was struggling with getting the word out there. He was talking about likes on Twitter, engagement, paid PR in the coin media noise-pumping machines, and other nonsense. He also spent 20k/month on the marketing team that delivered nothing.

Now, the founder is a builder at heart. He is a technical person and not really a Tai Lopez type of guy. His product is really good, his vision makes sense and he solves problems for other devs. Also, it’s not a D2C but a B2B product. Why on earth would you care about likes then?

Marketing in the bear market is very different from the bull market. Therefore, I have decided to write this little article about what I think works and what does not.

Conmunity (not a typo)

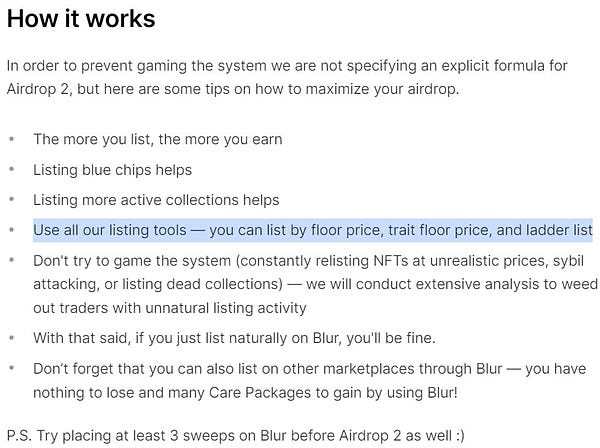

Community is a meme. There are very few projects that actually maintained a loyal and engaged community in numbers. This is a simplified dissection of a typical crypto community:

The “heart” of your “community” is what you have to focus on. The best is if “I’m here because I love the product” equals “I’m here because I love TO USE the product”. The rest really do not matter that much because their participation is usually strongly dependent on their ability to make money on the token. In the bear, the pumps are short-lived.

That is why, the job #1 is to focus on the “heart” of the community.

This can be 10 to 100 people. These are the devs and the power-users, those who will stick around as long as you still have a chance to succeed at whatever you’re doing. If you do not have this heart or core, you better find them soon.

People think that having overpopulated Discord and 100k followers on Twitter is important. What truly matters is how many people actually care about the product enough to interact with it on a regular basis and yammer their friends off about how cool it is. The projects with a strong core are in the best position to survive market downturns and actually iterate to a meaningful PMF.

Let’s Get Physical!

Say that you're the founder that is just releasing a beta and new docs describing how revolutionary your product is. What not to do is spend money on:

Marketing agencies

Inflated marketing team

PR articles

A booth on the next corpoevent sponsored by a corpochain

Social media ads

Other not-to-dos include non-financial matters like:

Obsess about likes and follower counts

Obsess about the token price (if you have a token)

Release 50 pages long whitepapers explaining why you’re so good expecting people will read those

If you’re just getting started you need to get your hands dirty. You actually should travel and visit dirty hacker houses, low budget meetups, avoiding massive corpo events. You have to find your core audience. Whether it’s four, ten or twenty people, these are extremely important.

This is nothing new as Paul Graham has talked about “doing things that don’t scale” a decade ago. This wisdom never gets old.

Nothing replaces hearing about the project from a dedicated founder. It might be time consuming but if you do not have the core yet you must acquire these yourself - you, the founder. Talk to everyone you meet. Explain the problems you’re solving to people whose life will get 10x better using what you have built.

If nothing, people will remember you. They'll likely forget a tweet that made numbers for you in the next 5 minutes, but the chances are much higher if you keep explaining for 10 minutes about how great your product is.

Getting out there to spread the word early on is a burden that most founders must carry for a while to form the heart of their community. It is the heart that will carry on building the community organically. Only then it is time for community managers and marketers to enter the room.

Some founders got lucky with having the heart of the community from the get-go. Some must grind because they have started at the periphery of the crypto community. Important to note is that small yet loyal is better than big and barely interested. Compact communities can communicate better and iterate faster, providing a solid foundation for future growth.

Scaling The Communication

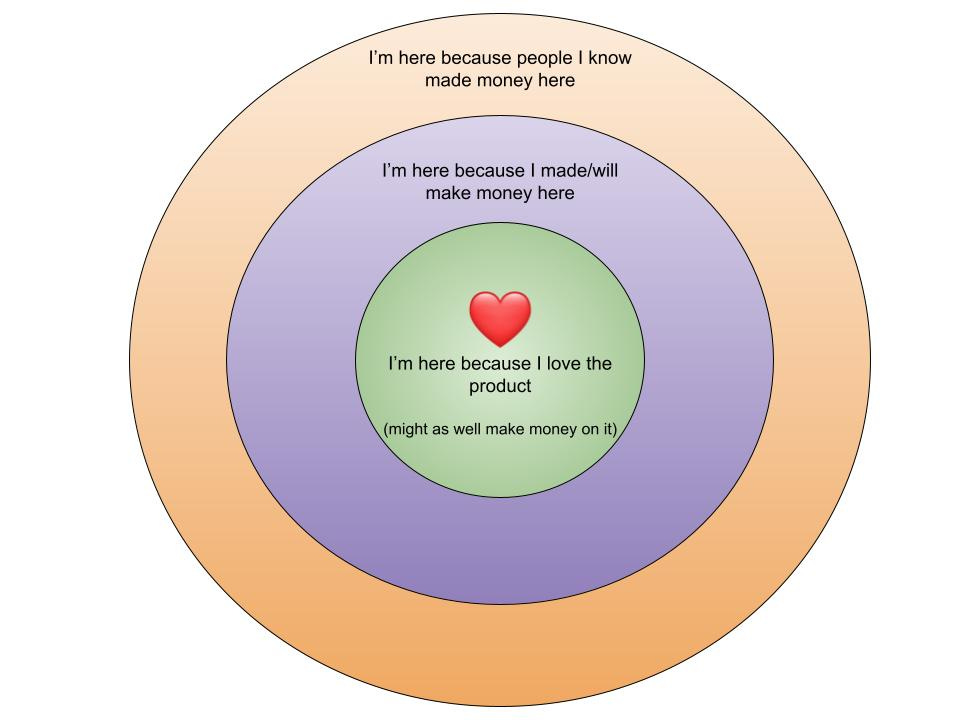

Think of the heart of the community as your innovators. These will act as a binder for your early adopters as they join. But how do you attract the next wave?

Firstly, your community core will do the job. If they are really excited about the product they’ll tell people around them. The word of mouth really works - NPS (Net Promoter Score) is referred to as the key metric in predicting user growth in startups. Crypto is no different.

The willingness of your existing users/community to recommend your product to their friends is key. Assuming you have a great product, it should not take a long time for people to figure it actually is great once they’re using it.

If you’ve done your job spreading the word yourself, it’s time for a more scalable way to tell people. Whitepapers are too demanding, light papers are so 2018, blogposts are better, and tweets are efficient yet extremely competitive.

I would therefore recommend podcasts. There are so many podcasts in crypto and people just love listening to them. Again, I’d recommend not trying to appear on the big ones but rather choosing a specific niche.

Choose a small pod. Even if it has 100 or 1000 dedicated listeners but you’d think it’s a solid audience - go for it. You have to work your way up, simplifying the message the bigger the audience gets.

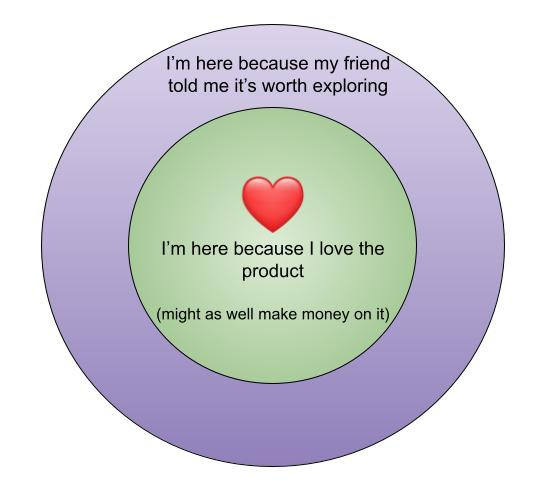

Only once you reach that threshold of your core community being able to “onboard” new members - it’s time for memes.

Memes Of Production

Chainlink and Synthetix are the projects that were able to make it in the last bear market. Both had an existing product that attracted users, one managed to do better on the incentive side the other was able to secure a prominent exchange listing that helped liquidity. The prerequisite however was a product and a core community.

Then came memes. LINK marines and SNX spartans were the marketing trolls spreading the word about the product, spamming cryptotwitter, and inevitably attracting new users.

Memes need virality and a witty picture by itself is not going to cut it. If you have substance (the product) then you need a carrier for the memes. That’s your innovators+early adopters. This is when the growth accelerates to the early majority, signalling it’s a good time to build/hire a marketing and bizdev team.

If you want to know how to create a good meme then I must disappoint you because there is no guaranteed way. We at Zee Prime often repeat that a good meme relies on the reduction of nuance and emotional appeal. That is as far as I can go in recommending a recipe for a solid meme.

The best memes are usually a result of collaborative intelligence - the community comes up with them organically by remixing inside jokes and product messages. Pushing manufactured and non-organic memes is cringe and essentially these are not memes but mere pictures that are devoid of the ability to percolate the key message on the forums and social media.

Bribing Users

In the bull market, paying users to use your product qualifies as a good UX. The liquidity mining token distributions and airdrops were the hallmarks of the 2020/21 kettle season. With the benefit of hindsight, we can conclude that freebies don’t work in the long run.

Much of the traction in DeFi, NFT, and GameFi has been purely speculative. Ponzis have clearly worked. But once you decide to go that route you must know how to eventually course correct into sustainable tokenomics and transform speculators into users.

At Zee Prime, we have written an article on improving community distribution. The practice of acquiring users with token incentives is gradually improving.

Indeed Synthetix made it out of the bear market with their liquidity mining incentive scheme and to some extent that user acquisition strategy was revolutionary. But now, thinking beyond DeFi, projects should be careful using token distribution as a user acquisition tool in the early stage.

Tokens are a marketing tool, but again, distributing tokens before PMF is not the best idea. If you still want to reward early users you can build a gamified in-app token that could in time make users eligible for a claim on the real token. Brahma went the extra mile to gamify their early community rewards.

The Summary

Assuming you are a founder with a great product lacking an audience the best way to do marketing in these tough times is to:

Engage with people whose problem you’re solving, best if in person, attending small meetups and traveling through grassroots hacker houses

Once you build a small group of loyal users/community contributors, scale your reach by choosing a set of niche podcasts, write concise blogs, and hire a community person

Once you have reached your early adopters that have been onboarded/integrated into the community by innovators - it’s time for memes. Now you can start building your marketing and biz dev team

If you have a token and plan to use it as a part of a user acquisition strategy don’t use it prematurely and think hard about the design. Freebies do not work.

This is not the approach that is suitable only for the bera, but generally a healthy approach to marketing in crypto. In bull markets even the driest of propositions can ignite a massive forest fire of infinite gains - price comes first and everything else is secondary.

In the bear market focus on turning speculators that are still interested into users. Also, the order of things becomes much more important. Prematurely going big on marketing might yield no return. Keep it small, keep it organic and make sure you grow into a massive campaign.

The ultimate truth is that there’s no silver bullet but there are better and worse practices.

now crypto marketers and event organizers are hating you