Harsh Truths (Not Only) For Crypto Noobs

Surviving The Winter

Receiving positive feedback on my old post “Simple & Short Guide for Crypto Noobs” made me think about how I can provide more helpful tips for the new blood. I think the noobs matter and it is important they stick around after the chaos.

Crypto attracts exceptional minds. Some, however, use their talent to play zero-sum games. Then there are those that decide to create and play positive-sum games. These positive-sum games stem from innovation.

Sometimes this can be confused with imitation. In some sense imitation is where creativity comes to die. On the other hand it also plays an important role - imitation is how innovation (ideas, assets, etc.) propels its way forward. Throughout the cryptocycles it can become increasingly hard to distinguish between the two.

I would not think of the following as tips or advice but interesting points that can be adopted as guiding principles. These are the lessons I have learned. They are labeled as truths because they are part of an ever-repeating pattern that goes beyond crypto.

The following is not ranked in importance as different truths have different importance for different individuals.

Truth #1: People will fall for individuals playing zero-sum games and profiting from imitation again and again

This is nothing new and it’s not exclusive to crypto. One can learn a lot by studying the anatomy of financial bubbles from a Girardian perspective and even more actually living it. This will not help you time selling the top but it’ll make you more aware throughout cycles.

“Every bubble begins with something real, which inspires entirely too much fakery. It begins with Da Vinci but gets dominated by Peter Paul Biros because while genius is rare, the demand of the credulous will always be met by a healthy supply of fraud.”

Sometimes it is hard to distinguish what you want to believe and what you truly believe. Therefore, asking oneself: “Do I want this to be true or do I truly believe this is true?” - is a good exercise from time to time.

Truth #2: It will not be easy

Zee Prime Capital was conceived in very late 2018, during the most bearish part of the previous cycle. It was not easy to have high conviction and it was not easy to believe in teams building new things.

We never bought the bottom or sold the top, and we never really obsessed about it. We were looking for people who actually had ideas that we found interesting. At the end of the day, in the spirit of “England has its railways despite the financial bubble becoming a part of it” we can conclude that DeFi and NFTs have laid the piping for new cycles of innovation (and imitation).

Being able to distinguish between the crazy ideas and the real ones is almost impossible as sometimes the barrier is too thin and subject to reflexivity. It is therefore a numbers game and that’s where VC type of portfolio diversification makes sense.

Truth #3: Some things might not survive

If you consider something as inevitable you will make no effort to work toward it. If enough people will get complacent - no one will survive. Do not take it as a given. Criticize, scrutinize, and embrace those committing themselves to build new and complicated things.

Throughout 2022 I heard people saying that they worry about crypto less than in 2018. I worry about the same. Treating the future as certain can lead us to complacency and the future may never arrive.

Our industry continues to thrive only if we continue to reinvent ourselves. Also - we need to deliver better solutions. This is no easy feat. No more low-hanging fruits. Casinos alone will not do.

Truth #4: Buying the dip will get you rekt

Especially when you still hear homeless guys and tiktokers talking about buying the dip. The dip can keep on dipping. But that’s not the point. The point is you should buy when you have a conviction that is independent of what the masses are saying. Impulse buying is rarely a good idea.

This stands on its own, but stems from another harsh truth:

Truth #5: Wisdom of crowds will get you nowhere

The wisdom is to be found in solitude away from screaming crowds. The ability to be able to think for oneself is a rare commodity. Also, it’s almost impossible to be able to think clearly during mania or depression. You will scarcely find an opportunity by listening to the masses (or deciphering the soft footprints of the mystics).

Have your own ideas. Refine them. Test them. Scrape them. Bet on individuals testing theirs. See others joining the party and try to determine when a conversation you once had in a small room with a handful of people is hysterically debated on Twitter.

Then it is a counterintuitive dose of skepticism that will lead you back to your armchair to rethink these ideas. If you don’t have an armchair a desk will do too.

Truth #6: Most of what you do, read, or touch will come to nothing

Most of your time and effort are wasted. But there are a few things you’ll do that can get you to a whole new place. Embrace the asymmetry.

Human creativity has non-linear outputs. You may not even see that you’re on an exponential path. Even if you only have one great idea, build one great product, or make an investment in one single great thing - it’s all you need.

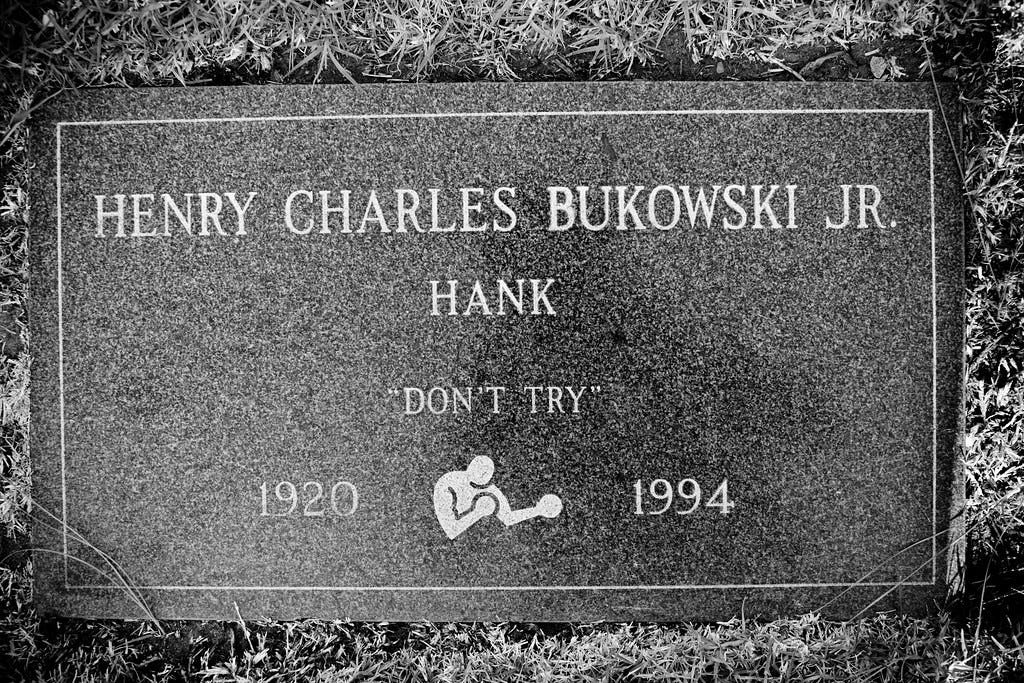

Truth #7: Trying too hard rarely works

“Wtf Matti? You just told me not to be complacent and now you’re telling me not to try?”

What I mean by this is - do not force it. Pure intentions are never based on trying too hard or going against one's own nature. If you’re not here to scam people the only way to make money in crypto is for the love of the game because only then you can stick around when most think this is a fool’s game.