I am writing this to accelerate the evolutionary process of elimination. Given the amount of money chasing private seed-stage deals, I feel obliged to help VCs fail fast.

Below is a list of tips and “howtos” to psyops VCs into investing in your (bs) idea. It’s very easy to follow and it should not take long to put a solid deck together. The hardest part is assembling the team. But there is a solution for that too.

Credentialism used to be key. It is still good to make sure you highlight things like a former Goblin Sachs or Morgan Stanley employee. Not a bad idea to include Stanford or MIT dropouts either.

If you don’t have a team, or you do not have credentials then just be an anon. This anon thing really helps. Why? - Because you might be an MIT dropout. It’s all about possibilities. If you don’t have the team at all, there is no need to have one. Just make them up. Be creative.

For the rest of the pitch/deck, you should follow a five-step design:

1. Problem

2. Obfuscation

3. Acceleration

4. The Clincher

5. Competition

Now let’s go through them one by one.

Problem

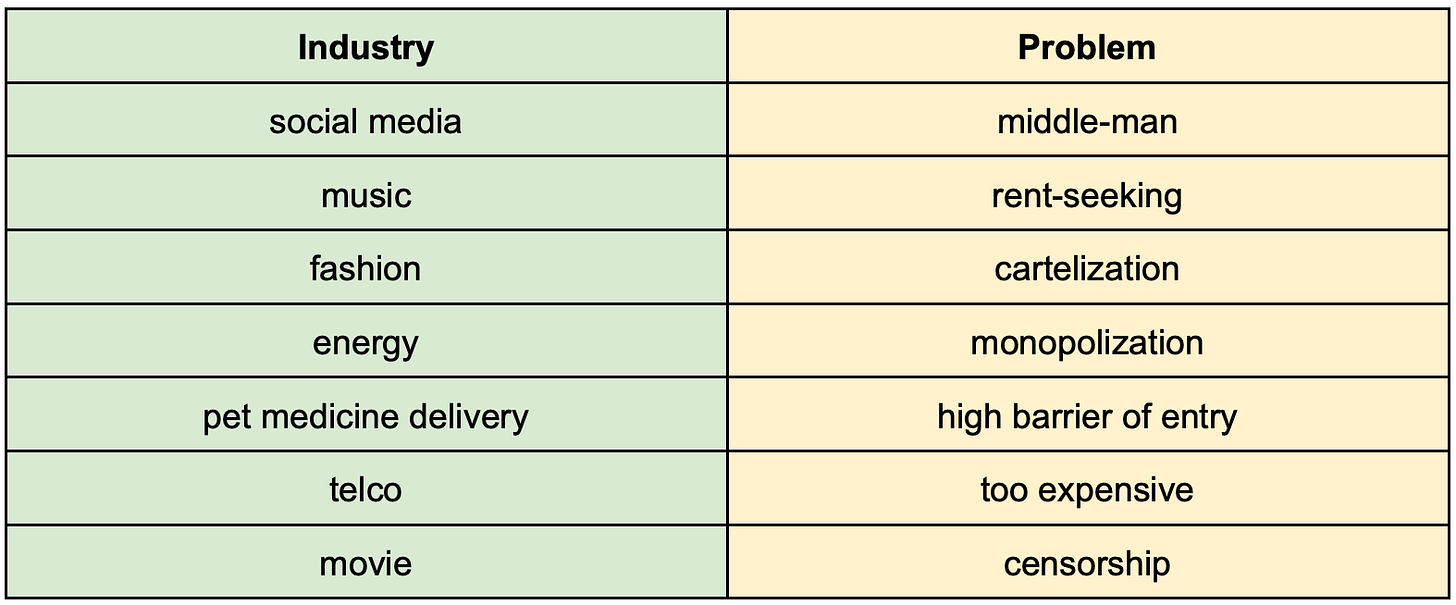

First of all you need to claim you are solving a problem. The best problems are those that are widely acknowledged. Best if you insert strong accusations against a particular group of evil entities that are pretty abstract.

e.g. “The music industry is run by rent-seeking labels”

The 2017 version was that banks are evil but that is already kind of old. But I hear some still go with that. I strongly recommend picking more trendy problems. To make it easier I provide a list of random industries and random problems but I promise you the options are infinite.

Obfuscation (aka Solution)

This is the most critical part. Even if the problem is not so good this could land you a good deal. Make sure you use at least three of these trigger words: NFT, Web 3, gamified, X-to-earn, value capture, governance token, DAO, and the metaverse.

The second ingredient to this part is complexity. Just add some complex mechanism that appears to be solving something. Ideally, you want to make it so complex that the investors forget what the original problem was but not too complex so that it’s still familiar. You can achieve this by slapping an NFT or governance token somewhere.

This is a careful balancing act. Don’t forget, you’re selling something new but not that new. Your project should be outside of the box not “outside of the box that is outside of the box”. Any questions about redundant complexity should be followed up with this is “a cryptoecnomic design that aligns incentives of parties involved”.

Acceleration

If you managed the previous section well this will get them really excited. Here, you hit them with something they don’t expect. Boom. Make up stuff. The wilder the better.

You can be creative here. Either go for a made-up or out-of-the-context statistic, scientific reference or absurdly overestimated TAM. Even obscure iconography would do. It does not matter. The goal is to shock the audience.

A bulletproof acceleration could be based on the theme of “We are so early!” or “The TAM is 100 trillion!”. Exponential charts or comparing yourself to something trendy works well too.

The Clincher

This is the easiest part, however, it requires you to actually have a call with investors. Just memorize the phrases below and slip them into the conversation.

“So I cannot say who will lead but waiting for Kyle to respond next week.”

This will make them think - which Kyle? Davies? Samani? Damn, I better be fast. Even if they know one of the Kyles and they check with him it still can be the other Kyle. Or some freaking Kyle they’ve never heard of - OMG I cannot be bested by Kyle!

“We’re talking to a16z”

This is like a myth in the industry. Everyone talks about them, some even claim they joined them but no one has ever seen them. They just appear in big deal Announcements (capital A) but my guess is they’re probably just AI-generated characters.

“I’d like to know what is your value add?”

Now this will make the VCs sweat as now it is them who has to make up stuff.

“Let us know your allocation by the end of the week and we’ll let you know how if we can squeeze you in.”

There’s nothing like the oversubscribed round FOMO.

“We are looking to decentralize soon”

Nothing beats a good ol’ decentralizooor as this often means early liquidity for the allocatooor.

Competition

Easy-peasy. We are using competition to reassure the investor by indirectly showing that other investors are in this market but through other projects. Also, you show them why they are the best investors because they are investing in a better project than their competition.

Make sure to check your target VCs portfolio!

This part of the deck is seemingly about your project but in fact is all about the investors and their insecurities. Ideally, come up with four to five competitors and make up different attributes in which you tick the box on all of them while your (their) competition is missing some.

Answering Questions

Any hard questions should be answered with: “We let the community solve the problem.”

Case Study: zoomNiFTication

To make sure we can translate the theory into practice let me present you with a made-up deck. I’m creating a template company called zoomNiFTication.

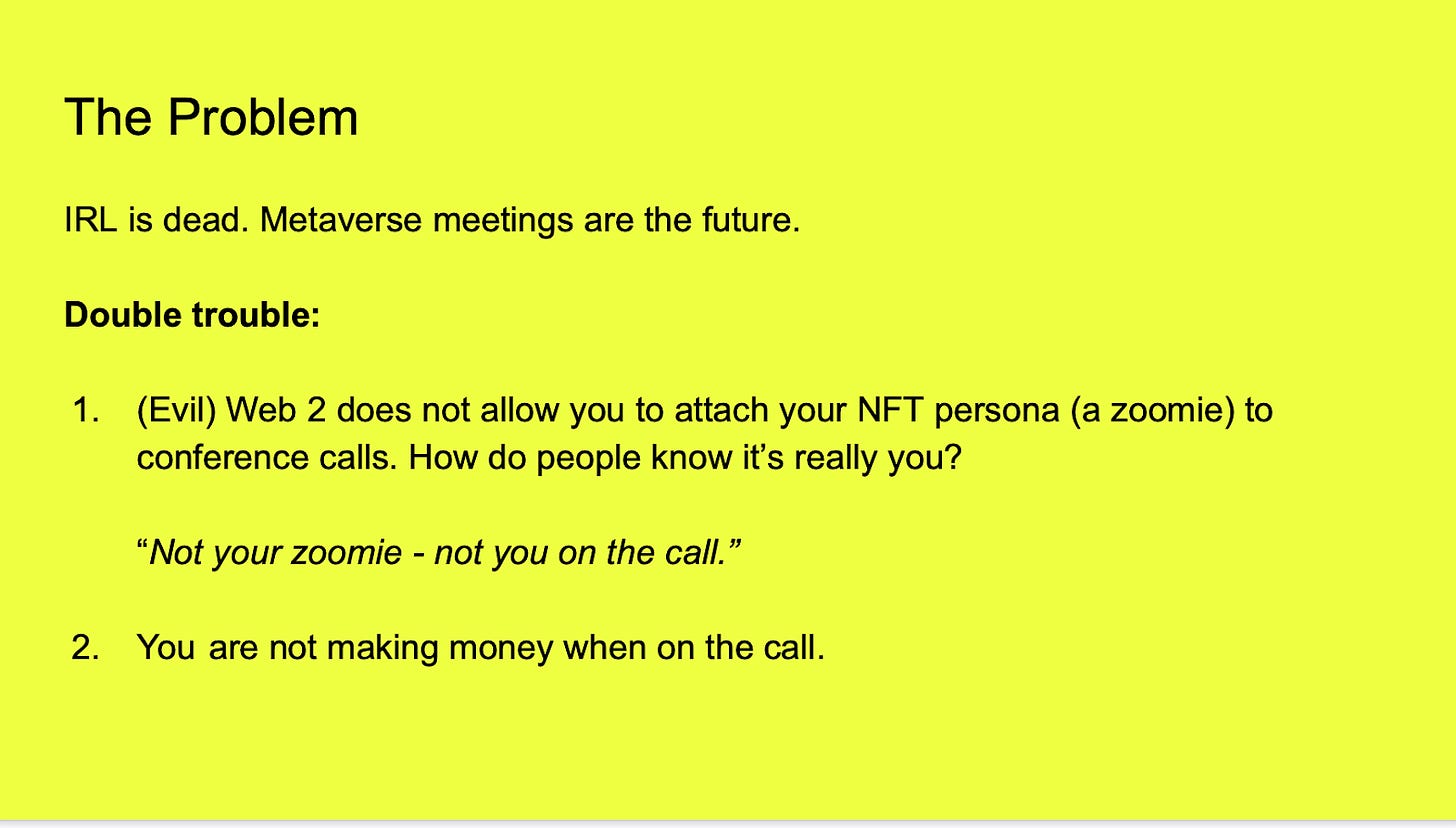

The problem definition is very simple:

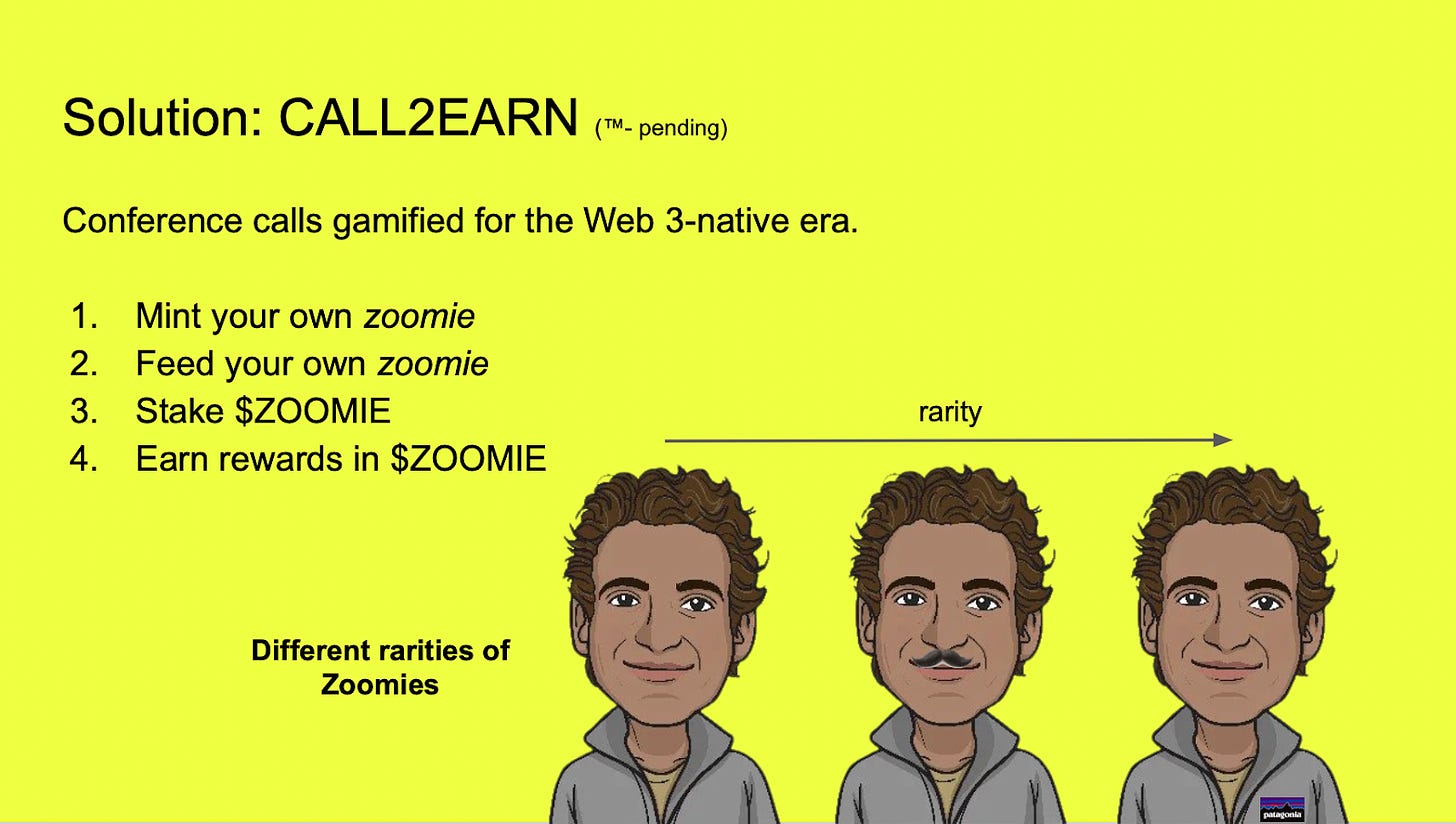

Our company applies the right buzzword to solve this problem:

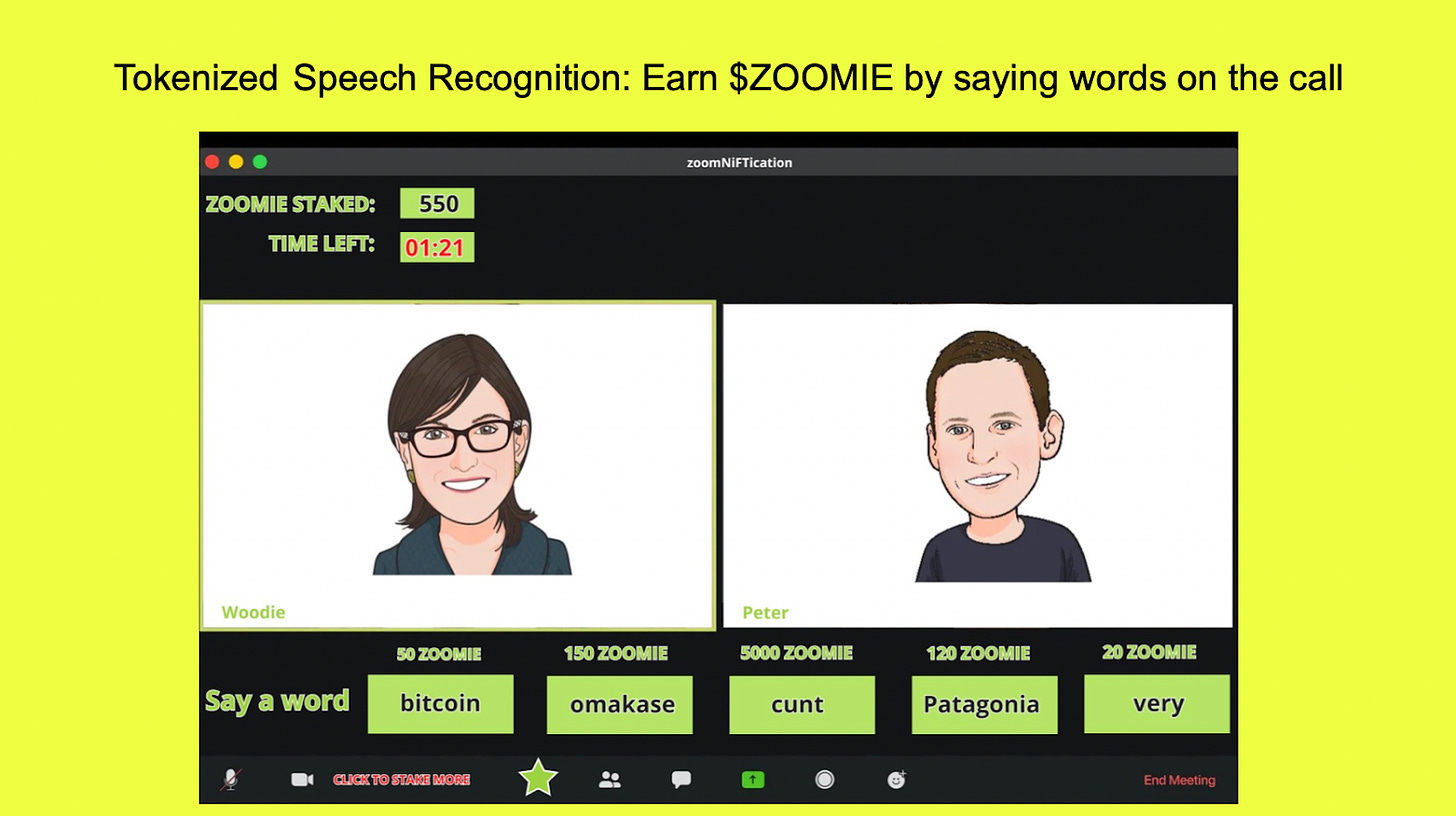

And the gamification does not stop here:

Now the killer feature to make calls fun again:

Buckle up. We’re going to accelerate:

Not stopping here folks. We’re smart and we know how to make money:

No competition in Web 3 or Metaverse. We are the first movers:

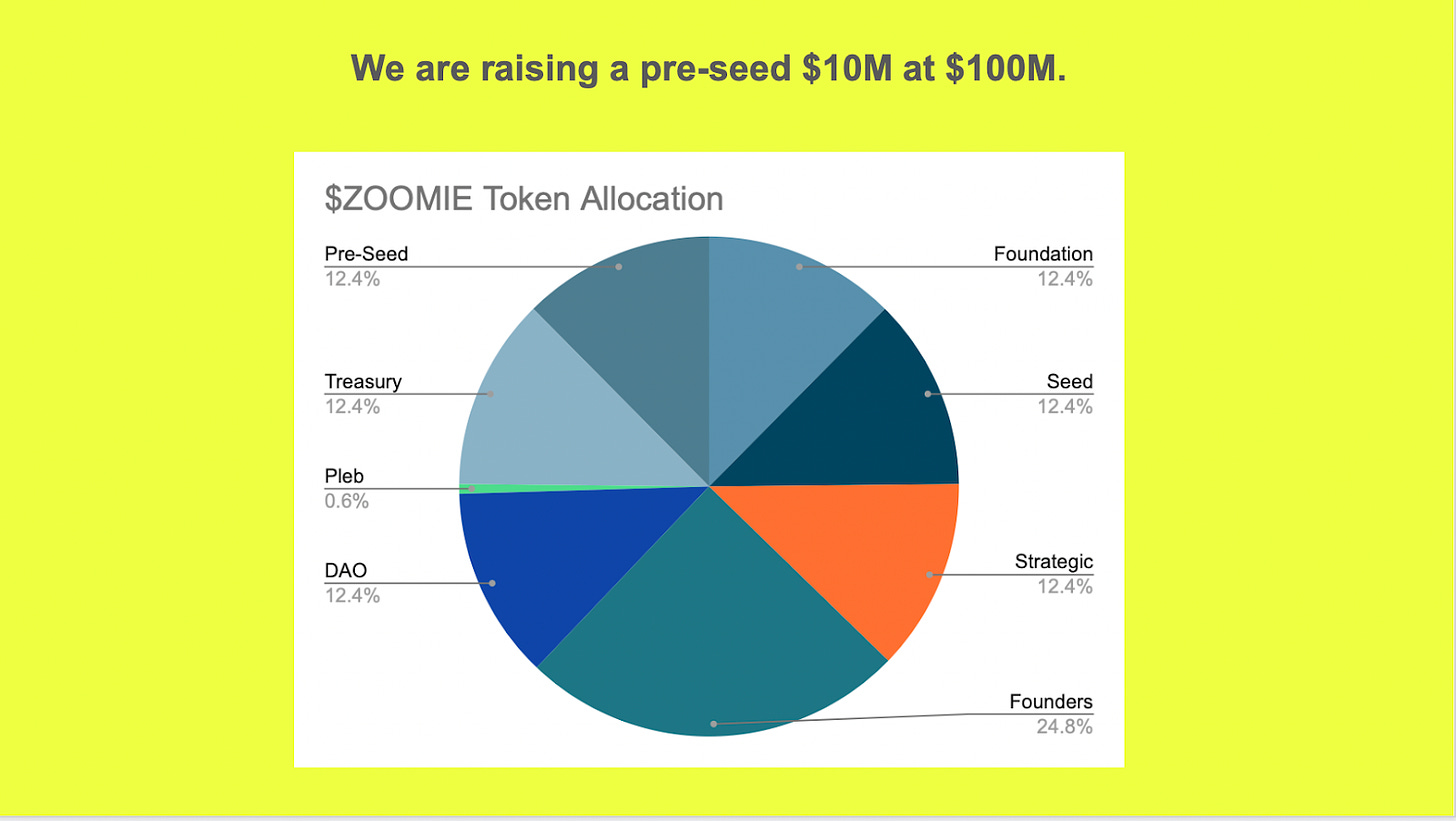

Make sure it’s a great deal but also a fair token distribution. Round numbers for valuations are better as investors can easily do the math:

Landing a seed round these days is as easy as stealing a toy from a two-year-old. Even though this is an obvious shitpost I’m sure I’ll get at least 2 offers to lead. The images of “zoomies” are stolen from alias.co with the founder’s permission.

easily the funniest sub i read this year, ty

This made my day, lmao